Navigating the Ups and Downs of Mortgage Rates: A Homebuyer’s Guide

Are you trying to make sense of the fluctuating mortgage rates? If you’ve been caught in the crossfire of conflicting reports — one day hearing rates are falling, the next day reading they’re climbing — you’re not alone. Understanding the dynamics of mortgage rates can seem daunting, but it’s crucial for making informed decisions in today’s housing market. Let’s break down the mystery of mortgage rates and offer some clarity.

Why Mortgage Rates Fluctuate

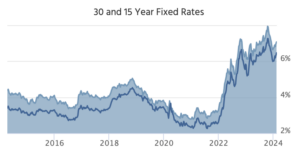

Historical Trends: A Comparative Look at 30-Year vs. 15-Year Mortgage Rates Over Eight Years

Mortgage rates are a reflection of a variety of economic and global factors, including economic conditions, Federal Reserve decisions, and more. This results in a naturally volatile mortgage market, where rates can quickly rise or fall. For a visual representation of this volatility, check out Mortgage News Daily for up-to-date graphs showing the fluctuation of the 30-year fixed mortgage rate.

Short-Term Changes vs. Long-Term Trends

When you look at mortgage rates, the timeframe you consider can significantly affect your perspective. A short-term view might show rates trending upwards, but a broader look comparing current rates to those from a year ago, such as last October, might reveal an overall downward trend. This highlights the importance of focusing on the bigger picture rather than getting caught up in daily fluctuations.

The Bigger Picture for Homebuyers

What does this mean for you as a prospective homebuyer? Despite the day-to-day uncertainties, the general movement of mortgage rates over the past year has been downward from their peaks. This is encouraging news for those looking to buy, suggesting that, on the whole, borrowing costs may be more favorable now than they have been in recent times. Industry experts, as quoted by Realtor.com, generally anticipate this trend could continue, making now an opportune time to consider entering the market.

Seeking Professional Advice

Given the complexities of the mortgage and housing markets, consulting with a professional can provide invaluable insights. A real estate or mortgage professional can help you navigate the current landscape, ensuring you’re making decisions with the most accurate and comprehensive information at your fingertips. For guidance on finding the right professional, resources like Zillow’s Real Estate Agent Finder can be a great starting point.

Conclusion: Empowering Your Homebuying Journey

Understanding mortgage rates is more than just keeping an eye on the latest numbers; it’s about recognizing the trends that impact your homebuying journey. By focusing on the long-term outlook and seeking expert advice, you can navigate the market with confidence. Remember, in the realm of real estate, being well-informed is your greatest asset.

Thank you

If you found this content valuable and engaging, we invite you to explore our blog for more insightful articles and resources. Stay informed and inspired by delving into a wealth of information designed to enhance your knowledge and enrich your experience in the world of real estate.